THE CARLYLE GROUP

Despite climate pledges, Carlyle invests heavily in fossil fuels

While global authorities call for immediate climate action, Carlyle’s emissions disclosure omits some of its dirtiest investments

Download Report Read More View Scorecard

Carlyle’s investment strategy is at odds with the global push for a sustainable future and puts investors at risk.

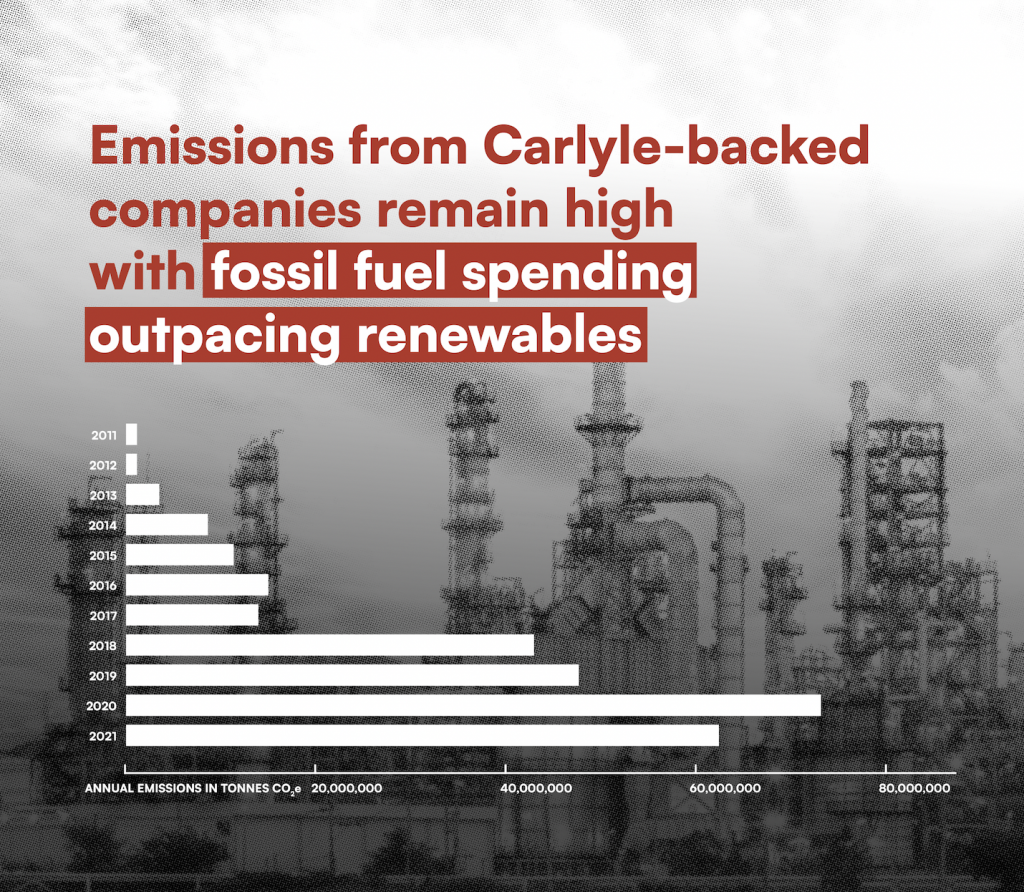

Despite the growing urgency for climate action and investors prioritizing environmentally responsible investments, The Carlyle Group remains focused on oil and gas. Its investments over the past decade have resulted in significant emissions of CO2 and other greenhouse gasses.

FACT: CARLYLE’S 2022 ENVIRONMENTAL RANKING WAS A FAILING ‘F‘ GRADE. VIEW THE SCORECARD HERE.

Their lack of a credible energy transition plan exposes investors to potential financial risks and suggests a disconnect between their public commitments and their actual investment practices.

Carlyle’s energy portfolio is lopsided, making 94% of its energy investments in fossil fuels.

APR 2023 REPORT

The Carlyle Group’s Hidden Climate Impact

As one of the world’s largest private equity firms, the Carlyle Group invests heavily in fossil fuels, despite the urgent need to transition to renewable energy. For every $1 invested in renewable energy, Carlyle invests $16 in fossil fuels, exacerbating the global climate crisis.

Carlyle’s energy investments from 2011-2021 is heavily skewed toward fossil fuels with $22.4 billion in carbon-based energy and only $1.4 billion in renewables. This resulted in an estimated 277 million metric tons of CO2 emissions, which would take 4.6 billion newly planted trees ten years to remove.

Learn more about the financial and reputational risks of Carlyle’s fossil fuel investments and their impact on the planet and communities.

KEY POINTS

Carlyle Group has a heavily fossil fuel-focused energy portfolio, with $22.4 billion in carbon-based energy and only $1.4 billion in renewable energy.

Carlyle’s energy investments significantly contributed to the firm’s earnings, generating around half of profits in 2022.

Private equity firms like Carlyle exploit regulatory exemptions and loopholes to contribute to greenhouse gas emissions without much public scrutiny or oversight.

Carlyle’s fossil fuel investments from 2011 to 2021 emitted an estimated 277 million metric tons of CO2e, with yearly emissions exceeding those of entire countries.

Navigating climate risks: A guide for institutional investors

Institutional investors face significant climate risks through private equity’s investments in fossil fuels. To safeguard investments and contribute to a sustainable future, consider the following steps:

- Demand Transparency:

Request private equity managers to align their portfolios with science-based targets, keeping within a 1.5 degree Celsius warming pathway. Ask for full disclosure of fossil fuel holdings, emissions (Scopes 1, 2, and 3), energy transition plans, and climate lobbying efforts.

- Evaluate Transition Strategies:

Assess how well private equity firms are adapting their portfolios and energy strategies for the clean energy transition.

- Prioritize Climate & Environmental Justice:

Ensure private equity firms integrate climate and environmental justice considerations, accounting for the communities and workforces impacted by the climate crisis in their investment strategies.

- Reallocate Capital:

Shift capital investments toward private equity firms credibly transitioning away from fossil fuels and providing transparency about their holdings, emissions, and impacts.

Analysis is developed jointly by researchers from Americans for Financial Reform Education Fund, Global Energy Monitor, and the Private Equity Stakeholder Project.

About Americans for Financial Reform Education Fund

Americans for Financial Reform Education Fund (AFREF) is a nonpartisan, nonprofit coalition of more than 200 civil rights, community-based, consumer, labor, business, investor, faith-based and civic groups, along with individual experts. Our mission is to fight to create a financial system that deconstructs systemic racism and inequality and promotes a just and sustainable economy. Follow AFREF at ourfinancialsecurity.org and on Twitter @RealBankReform.

About Global Energy Monitor

Global Energy Monitor (GEM) develops and shares information in support of the worldwide movement for clean energy. By studying the evolving international energy landscape, creating databases, reports, and interactive tools that enhance understanding, GEM seeks to build an open guide to the world’s energy system. Users of GEM’s data and reports include the International Energy Agency, United Nations Environment Programme, the World Bank, and the Bloomberg Global Coal Countdown. Follow GEM at globalenergymonitor.org and on Twitter @GlobalEnergyMon.

About the Private Equity Stakeholder Project

The Private Equity Stakeholder Project (PESP) is a nonprofit organization with a mission to identify, engage, and connect stakeholders affected by private equity with the goal of engaging investors and empowering communities, working families, and others impacted by private equity investments. Follow PESP at pestakeholder.org and on Twitter @PEstakeholder.